FINANCIAL LITERACY, INVESTMENTS

How Much Cash Should You Keep?

Joseph A. Davis, CDFA®

October 6, 2016

Keeping cash under a mattress may be an outdated idea, but it’s important to include cash or cash alternatives in your financial strategy. The amount of cash you need — and where to keep it — depends on your situation. To some extent, it’s a balancing act between short-term needs and long-term goals.

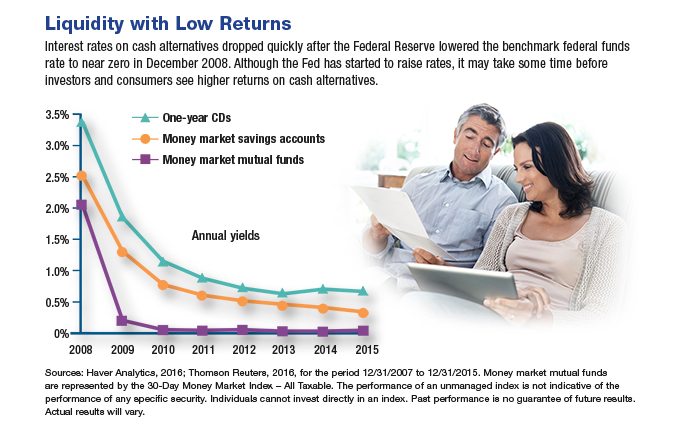

Interest rates on savings accounts — and cash alternatives such as certificates of deposit (CDs) and money market mutual funds — are very low, and it may take several rate hikes by the Fed before they begin to budge.1 Even with low inflation, these assets might lose purchasing power over the long term. However, the liquidity and stability of cash vehicles can be very helpful in the short term.

Emergency Funds

A typical guideline suggests having an emergency fund equal to three to six months of expenses, so you can pay bills in the event of a loss of income and meet unexpected expenses such as medical care, car repairs, or a new roof. For this purpose, a traditional savings account or a bank money market account (a savings account with limited check-writing privileges) can be helpful because the funds are readily available.

If you foresee needing cash in one year or more — for example, you expect to need a roof next year — you could put money into a CD, which typically pays a higher interest rate than a savings account. Keep in mind that CDs incur early-withdrawal penalties, so be sure you are comfortable tying up the funds until the CD’s maturity date.

Interest rates on cash alternatives dropped quickly after the federal reserve lowered the benchmark federal funds rate to near zero in December 2008.

Money Market Mutual Funds

Money market funds are mutual funds that invest in cash-alternative assets, usually short-term debt. They seek to preserve a stable value of $1 per share and can generally be liquidated fairly easily. Money market funds are typically used as the “sweep account” for clearing brokerage transactions, and investors often keep cash proceeds in these funds on a temporary basis while looking for another investment.

You might keep some assets in money market funds to balance riskier investments, but you should not look to them for growth. The amount you keep — other than funds for trading purposes — would depend on your asset allocation strategy. Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

The Federal Deposit Insurance Corporation (FDIC) insures CDs, bank savings accounts, and bank money market accounts, which generally provide a fixed rate of return, up to $250,000 per depositor, per insured institution. Money market mutual funds are neither insured nor guaranteed by the FDIC or any other government agency. Although money market funds seek to preserve the value of your investment at $1 per share, it is possible to lose money in such a fund. The principal value of some cash alternatives may be subject to market fluctuations, liquidity issues, and credit risk, in which case there is a risk of losing money.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) USAToday.com, December 17, 2015

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2016 Emerald Connect, LLC.

Follow These Two Rules to Build Wealth in Any Market

Throughout the past two and a half months I have continued to ask myself, did we jump off a financial cliff? The answer was no. How did I know? The answer, while somewhat complex, is profoundly simple.

Financial Planning in the Sandwich Generation

While it’s true that retirement accounts can be used to save for college, there may be negative consequences to doing so. It’s best to talk with a financial professional to determine the appropriate course of action and to make sure you’re on track to meet your goals.

Matchmaker: Maximizing Your Employer 401(k) Contributions

A 401(k) isn’t the only option for retirement, but it’s definitely one of the most attractive. In many cases, it offers free money and is relatively easy to roll over when you change jobs. A financial professional can help you prepare for retirement with a 401(k) that fits your current investment style and stage in life and adapts to changes in career or investment styles.

Splitting Retirement Nest Eggs During Divorce

Qualified plans, such as 401(k), profit sharing, defined benefit pension and money purchase pension plans, have defined benefits or defined contributions. A qualified domestic relations order, or QDRO, is required when dividing qualified plans.

Davis Financial LLC

A financial services firm servicing clients across Utah. We strive to understand your goals, help you manage your retirement planning, guide your overall wealth strategy and help minimize your tax liability through a long-term and trustworthy relationship.

Office Hours: M-F, 9am-5pm

Call Us: (801) 620-0586

Directions: Map It

Copyright © 2023 Davis Financial. All Rights Reserved.

This site is published for residents of the United States and is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security or product that may be referenced herein. Persons mentioned on this website may only offer services and transact business and/or respond to inquiries in states or jurisdictions in which they have been properly registered or are exempt from registration. Not all products and services referenced on this site are available in every state, jurisdiction or from every person listed.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA & SIPC., Headquartered at 80 State Street, Albany, NY 12207. Advisory Services offered through BEAM Wealth Advisors, Inc., a SEC Registered Investment Advisory Firm. BEAM Wealth Advisors, Inc. is a separate entity from Purshe Kaplan Sterling Investments. Joseph Davis, Registered Representative, Aaron Schuler, Jr, Investment Advisor Representative, Beam Wealth Advisors, Inc., Tax services provided by Davis Schuler & Associates, LLC. Advisory services offered by Beam Wealth Advisors. Davis Financial LLC, Beam Wealth Advisors, Inc., Davis Schuler & Associates, LLC, and Purshe Kaplan Sterling Investments are separate, unaffiliated entities.