On February 28, 2020, we signed the closing documents on a new office for our business in West Haven. I was relieved and excited to be moving forward after 3 months of hard work and negotiations. This expansion would allow us to hire new associates and the building would be an additional investment with great tax advantages. Unfortunately, immediately after our closing date, the COVID-19 pandemic took a firm and unshakeable hold on the world.

As I write, the coronavirus has claimed the lives of over 323,000 people. Just over 90,000 of those deaths have occurred in the United States. Within weeks of our closing date, we saw the stock market suffer the worst drop in over a decade. Shortly thereafter, due to mandatory social distancing, upwards of 33 million people have filed for unemployment.

Through all of this I began to question our decision to purchase this building. Did we bite off more than we could chew? Did I just violate my number one investing rule? To say that I was a stressed is an understatement!

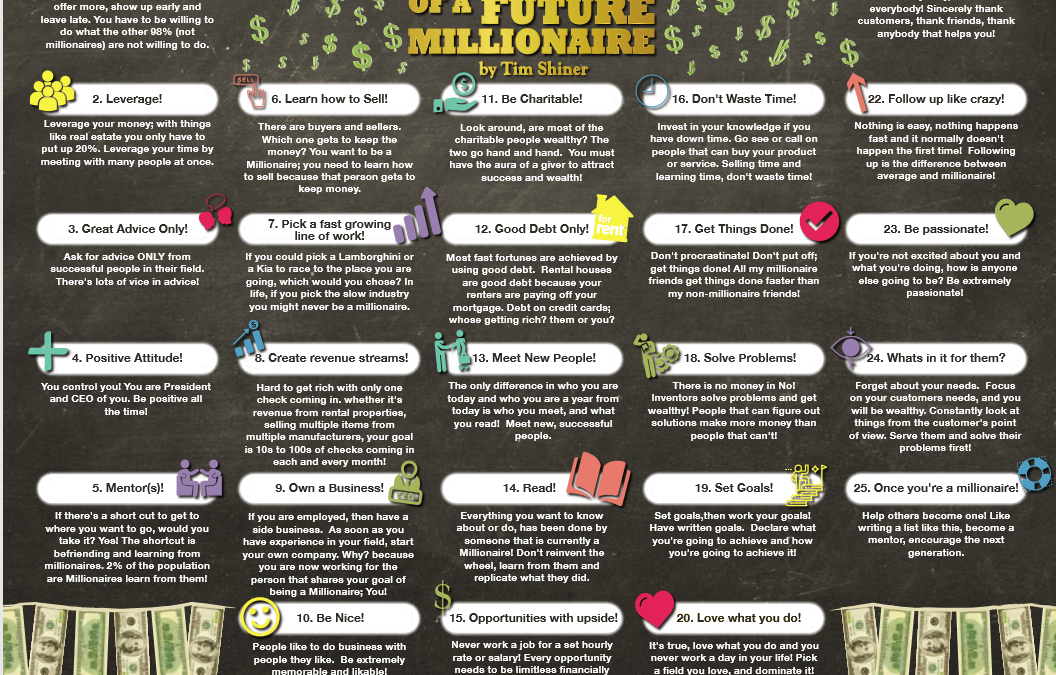

So, what’s my number one investing rule? I have Tim Shiner to thank for this. Spend enough time with me and you may find that I quote him often. I find his thoughts refreshing and I believe in them. His book, “50 Things They Didn’t Teach You in School” is one of my favorites. If you’d like a copy, send me a message or visit Tim’s site to get your own.

Over the years I have modified my “Tim Shiner-isms” to suit my investing style and behavior. One of my favorites has turned into a basic investing rule: “Be willing to step off a financial curb but don’t drive your family off a financial cliff.” Throughout the past two and a half months I have continued to ask myself, did we jump off a financial cliff? The answer was no. How did I know? The answer, while somewhat complex, is profoundly simple.

- True diversification is critically important to building and sustaining your wealth.*

- Multiple streams of income are critical to building and maintaining your wealth.

As we are coming out the other end of this pandemic, we now know for certain that we made the right decision. My wife and I reviewed our situation and not only were we okay, the timing actually couldn’t have been more perfect. Why? It boils down to diversification. Diversification must go beyond the stock market. If you do not know where to start, contact our office and we can discuss what we consider to be the perfect investing trifecta.

True diversification must go beyond the stock market

We hear the term diversification so much that I think in some cases it has lost all meaning. For example, how many people do you know that have a typical 9-5 job and invest in a 401k plan and maybe a Roth IRA? These are not bad investments by themselves. In fact, they are very simple and a great place to start if you do not have a good financial background. Additionally, traditional retirement plans can have relatively low risk compared to extremely complex investment vehicles such as oil & gas leases, non-traded REITS, real estate, and business ventures. However, through all of this I ask myself: If I only have one source of income and all of my money is in one asset, how do we call that diversification?

So, what should you be investing in? I recommend you start with what you know. Start small. Be willing to step off a curb but do not commit financial suicide. If the investment is too risky or complex to understand, do you really have any business participating in it? Spend time reading and improve your financial IQ. I am a voracious reader and maintain a large list of favorite books. Here is a short sample of some of my favorites.

Personally, I place my assets in a multitude of investments. Preferably, these assets are non-correlated. As one may drop in value or sustain losses, the other investments hold true and can grow. The perfect trifecta for me has always been real estate**, business interest, and equities. Additionally, we can hedge our investments by purchasing precious metals that connect as a hedge against inflation and the US dollar.***

I like going to the bank…a lot

A typical Saturday for me looks like this: I wake up around 6 am as I’ve always loved mornings and I am definitely an early bird. Ask anyone in my family. Spring in Utah is beautiful and a wonderful time to go for a hike. I’ll go for a hike and then come home, get cleaned up and go to the bank.

I love going to the bank. Before COVID-19 my kids loved coming with me too; albeit mostly for the candy handed out by the friendly bank tellers. I wholly subscribe to another “Tim shiner-ism” of trying to have as many checks coming in every month as possible. Almost every week I am cashing checks from various investments. Yes, I can do mobile deposit, but I love walking into a local branch. There is something about the face to face interaction with the people who work there. Invariable someone may ask me what I do. “Joe, are you a financial advisor and accountant or a divorce forensic guy?” I answered yes to all of those. I am also a landlord and a perpetual entrepreneur. I love trying new things and I have always loved the idea of not having to rely upon one source of income.

As my family has benefited from my wife staying at home to take care of our children, we have also had to rely 100% on me to provide income. Having one source of income has always seemed scary. Have you ever asked yourself these questions: What happens if I cannot work? What happens if I am furloughed or heaven forbid lose my business? What happens if the stock market crashes? Do I have enough savings to live for three to six months without my primary income source? Do I have alternative income sources or ways to generate income?

Having multiple sources of non-correlated income in addition to your regular day job can provide additional ways to grow and build wealth and it can be fun! You can include your children. My children recently establish a business partnership and will be operating this summer. Not only am I teaching my children the value of work, but I am also teaching them how to build and operate a business of their own. If we don’t teach our children these principals, who will?

If any of these ideas seem interesting or intriguing to you contact our office today and we would love to chat with you about our philosophies and how we can implement them to help you grow, protect and diversify your own wealth.

* Diversification does not guarantee a profit or protection from losses in a declining market.;

**Specific-sector investing such as real estate can be subject to different and greater risks than more diversified investments. Declines in the value of real estate, economic conditions, property taxes, tax laws, and interest rates all present potential risks to real estate investments.’

** Investments in precious metals such as gold involve risk. Investments in precious metals are not suitable to everyone and may involve loss of your entire investment. These investments are subject to sudden price fluctuation, possible insolvency of the trading exchange and potential losses of more than your original investment when using leverage.