Roth conversions occur when pretax money is transferred from a traditional IRA to a Roth IRA. The amount transferred over to the new registration is taxable, however there are no penalties. You can pay the tax directly from the account or you can pay it out-of-pocket through your own savings or other means. We prefer the later. This allows the account to grow tax deferred and potentially have 100% tax free distributions. Sounds good! It’s important to remember that any conversion will be included as earned income, which could potentially push you higher or even into another tax bracket. Also, if you DON’T do this right – you could potentially face a 10% tax penalty.

Roth IRAs can be advantageous as the principal & interest are accessible when:

- The principal remains in the account for at least five years from the date of conversion.

- After five years and when the client is over 59 1/2 years old all distributions of principal & interest is 100% tax-free.

What happens when someone doesn’t want to wait until 59 ½? Can they access the funds earlier? The short answer is yes. A unique twist on this is a strategy takes time but allows individuals to access their principal contributions from a 401K plan or other qualified employee retirement plan well before they are 59 1/2 years old. We call this a Roth conversion ladder.

It’s important to note that there are two rules that apply towards the 5-year rule. One for qualified & the other for non-qualified distributions. Investopedia has a great article here. As always, consult with your personal tax advisor.

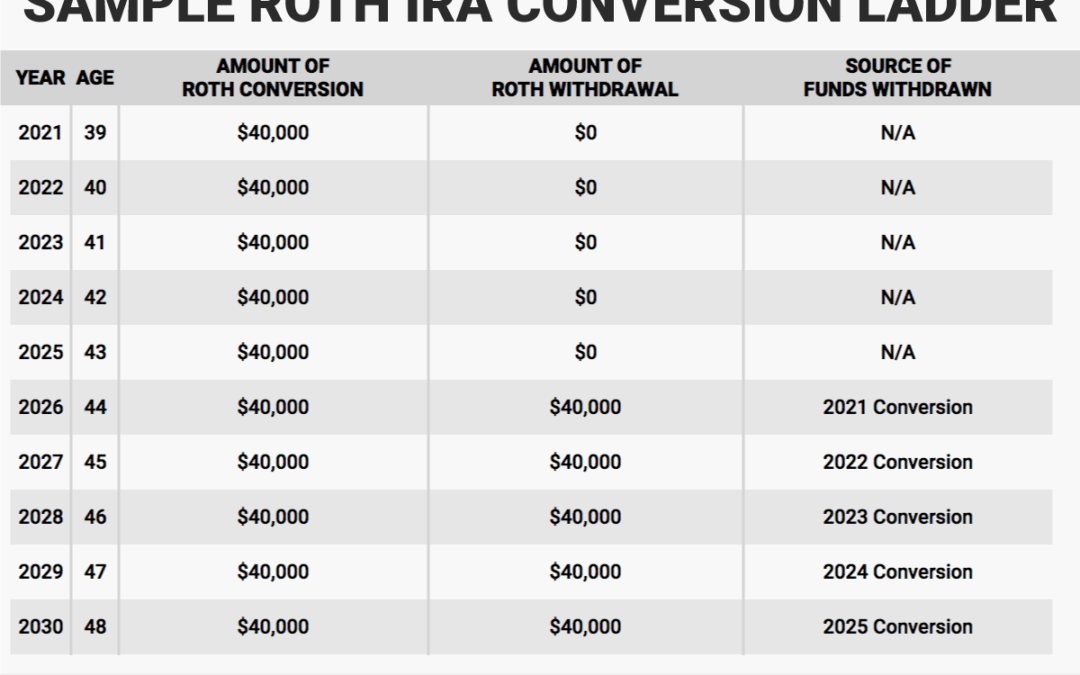

For this article – we are applying the second 5-year rule which creates separate 5-year periods for each conversion.

The strategy works like this:

- Upon separating service from his or her previous employer, an individual rolls the money into a traditional IRA from the employer sponsored plan.

- Working with their financial planner & tax advisor – the individual creates a plan to convert the traditional IRA to Roth over a period of years. They could convert it all in one year – however that may cause a significant tax liability, dependent on the size of the account.

- The individual then ensures to keep meticulous records documenting the principal amount of each conversion.

- Beginning five years after the initial Roth conversion all principal within the Roth IRA is now 100% tax-free for distributions!

While this particular strategy can take some time, this is a good and unique planning strategy to help individuals fund other investment opportunities and supplement their income or lifestyle without paying the typical 10% IRS penalty. Could they just pay the penalty or do what’s called a 72t distribution? Sure – but we will focus on these in a later article.

The following is a hypothetical example provided for illustrative purposes only:

Tom is 45 years old and has been saving in his 401(k) ever since he began working when he was 25. Over the last 20 years Tom has done well and accumulated $500,000 inside his 401(k). Tom is now self-employed & would like to use these funds for his business & other activities. Additionally, Tom is taking significant tax losses as his business is a start-up & wants to take advantage of his much lower than usual tax bracket.

He works with his financial planner and tax professional to develop a plan and strategy where he begins converting $50,000 per year and pays the tax out of pocket. Due to his savvy tax-planning, he is able to afford the additional taxes on this income.

After five years Tom has converted $250,000 of his initial $500,000 portfolio. In that same year (January 1st) – Tom can now access his initial $50,000. His subsequent conversions will also be available without taxation beginning in year 2 & so on. Assuming he continues to strategically convert over the next 15 years – he will eventually reach a qualified Roth IRA distribution age. Meaning once he reaches age 59 1/2 all of the interest within the Roth IRA will be 100% tax-free to supplement his income.

Your situation may dictate a larger or smaller distribution policy. It’s important to consult with your tax advisor in addition to your tax and financial professional to ensure a good planning strategy that understands your tax situation well.

As always – Happy Taxes!

This article original appeared on FindaCPAtoday.com. Securities offered through Securities America, Inc., Member FINRA/SIPC. Joseph Davis, Registered Representative. Tax services provided by Tax Smart Pros. Advisory services offered by Beam Asset Management. Joseph Davis, Investment Advisor Representative. Davis Financial LLC, Beam Asset Management, Tax Smart Pros and Securities America, Inc. are separate, unaffiliated entities. Joseph Davis, Investment Advisor Representative. Davis Financial LLC, Beam Asset Management and Securities America, Inc. does not provide legal or tax advice.