Want to retire early & access retirement funds without penalties? Read on!

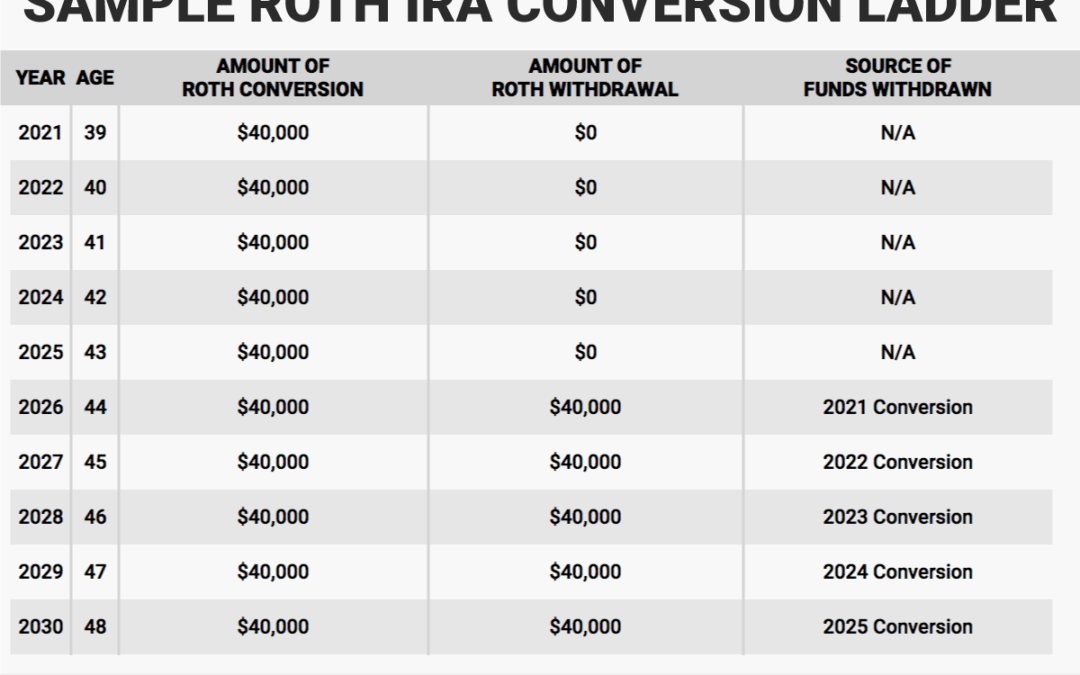

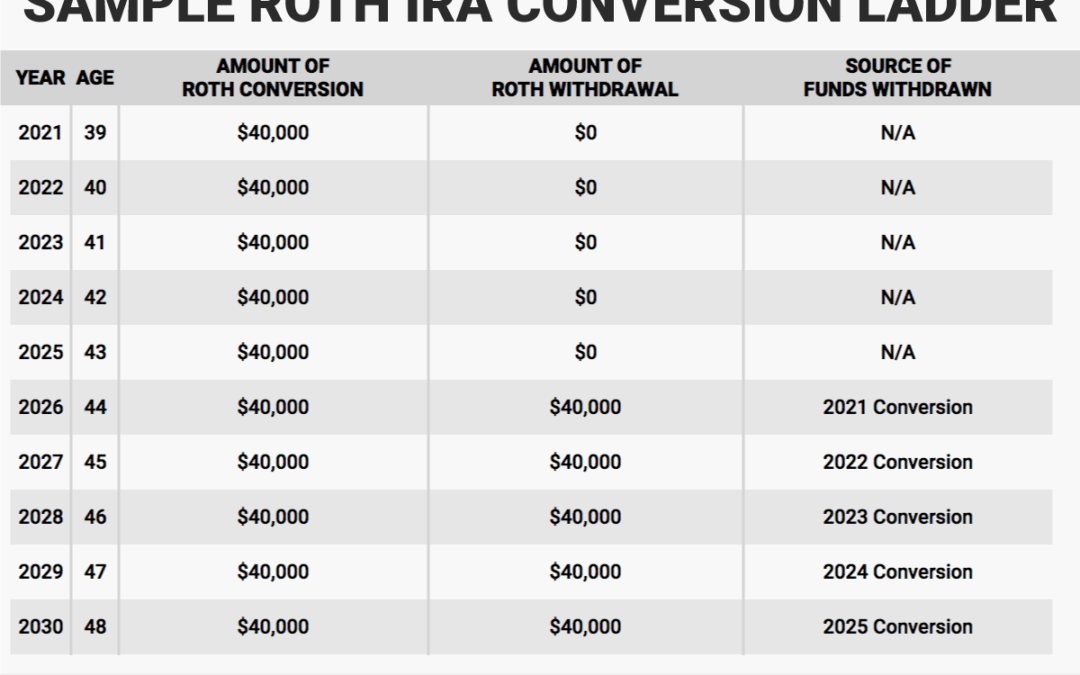

What happens when someone doesn’t want to wait until 59 ½? Can they access the funds earlier? The short answer is yes

What happens when someone doesn’t want to wait until 59 ½? Can they access the funds earlier? The short answer is yes

We are all players and use our financial education to improve our wealth and those around us. You can win as long as you understand the basic rules of the game.

One of the easiest ways to keep saving and investing goals is to set up automatic deposits or investments. Payroll deduction for 401(k) contributions or reimbursement accounts are great examples – you never have possession of the cash, so you don’t feel the pain of taking it out of your spending money. Contact your human resources department now about starting or increasing your contributions.

While the basic premise of “save & invest” is commonly understood, why do most people fail to do this? More importantly, how is saving money, when most people earn ordinary income, coupled with inflation, advantageous in a low to zero interest rate environment?

Building wealth is challenging & makes life interesting – Enjoy three tips to help you build wealth.

Financial resolutions can be especially difficult to stick with because, like eating and exercising, our spending, saving and investing habits tend to be tied to our emotions more than our logic. Here are five tips for keeping your financial resolutions.